Bear Lake County Treasurer

Tricia Poulsen

PO Box 55

30 N Main

Paris, ID 83261

(208) 945-2155 ext. 7

email, [email protected]

Hours of Business: 8:30 AM - 5:00 PM Monday - Friday

PO Box 55

30 N Main

Paris, ID 83261

(208) 945-2155 ext. 7

email, [email protected]

Hours of Business: 8:30 AM - 5:00 PM Monday - Friday

Chief Deputy Treasurer - Cami Shultis

email, [email protected]

phone, 208-945-2130 ext 1406

General Duties

Treasurer; The county treasurer is responsible for the safekeeping of all public moneys, which includes the acceptance, receipt and reporting of all money received by each county department. It is also the responsibility of the county treasurer to invest idle funds and ensure there is adequate money available to meet the county's financial obligations.

Ex-Officio Tax Collector; The county tax collector is responsible for the collection and accounting of all property taxes levied on the real, personal and operating property tax rolls. It is also the responsibility of the tax collector to provide notice to every taxpayer, his agent of representative the amount of property tax due no later than the 4th Monday in November each year.

Ex-Officio Public Administrator; The public administrator has the duty to administer the estates of decedents for whom no personal representative is appointed; the estates of decedents with whom there are no known heirs; estates ordered by the court and estates to which the state of Idaho is an heir.

email, [email protected]

phone, 208-945-2130 ext 1406

General Duties

Treasurer; The county treasurer is responsible for the safekeeping of all public moneys, which includes the acceptance, receipt and reporting of all money received by each county department. It is also the responsibility of the county treasurer to invest idle funds and ensure there is adequate money available to meet the county's financial obligations.

Ex-Officio Tax Collector; The county tax collector is responsible for the collection and accounting of all property taxes levied on the real, personal and operating property tax rolls. It is also the responsibility of the tax collector to provide notice to every taxpayer, his agent of representative the amount of property tax due no later than the 4th Monday in November each year.

Ex-Officio Public Administrator; The public administrator has the duty to administer the estates of decedents for whom no personal representative is appointed; the estates of decedents with whom there are no known heirs; estates ordered by the court and estates to which the state of Idaho is an heir.

ONLINE PAYMENT TOOLS

Public Notice

Public Notice

For Debit & Credit Cards, click MAKE A PAYMENT below

(Convenience Fee of 2.19% Applies)

For Electronic Check click MAKE A PAYMENT below then change the Payment Method to "Electronic Check"

(A $2.00 fee Applies)

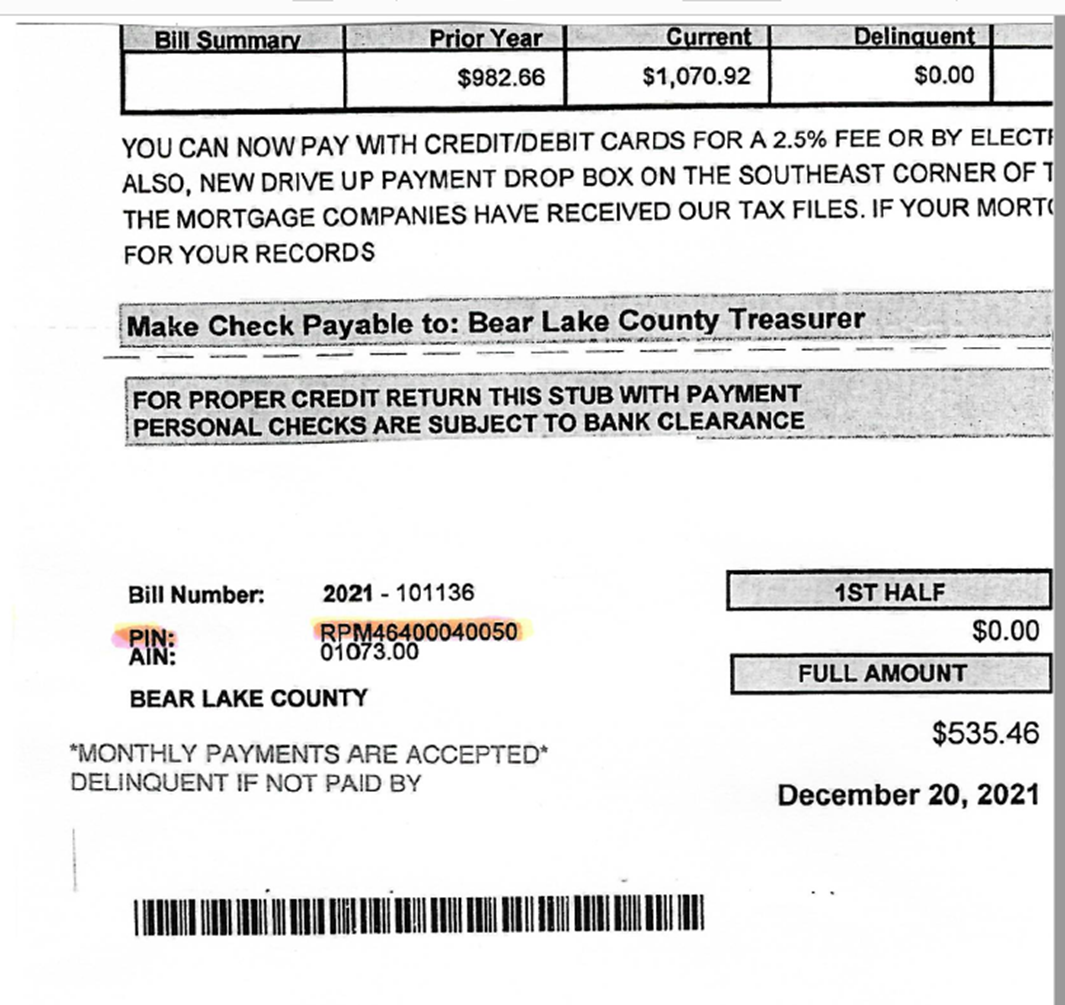

Please locate ALL of your PIN numbers at the bottom of your stubs BEFORE clicking “Make a Payment.”

**Failure to enter correct PIN numbers could result in your payment being applied to the wrong parcel!**

See Example Below

(Convenience Fee of 2.19% Applies)

For Electronic Check click MAKE A PAYMENT below then change the Payment Method to "Electronic Check"

(A $2.00 fee Applies)

Please locate ALL of your PIN numbers at the bottom of your stubs BEFORE clicking “Make a Payment.”

**Failure to enter correct PIN numbers could result in your payment being applied to the wrong parcel!**

See Example Below

Important Dates To Remember

Property Tax

To estimate next years taxes click the link below

Estimated Property Tax

Property Tax

To estimate next years taxes click the link below

Estimated Property Tax